The Recession Roadmap

Follow our Twitter and Linkedin Page !

Sign up for my email subscription so you don’t miss any of my portfolio updates!

Given that I won't be sharing my views over the summer for compliance reasons, this week I have written a piece on the potential scenarios that could play out in markets over the short and medium term. Alongside this, I have noted indicators to watch and the assets that will perform strongly in each scenario. I have given timeframes for each scenario as a guide, as it's impossible to know the exact timing. I hope this helps you navigate the investment environment over the coming months. Focus on the data and don't be misled by price action.

Before I begin, don’t forget about the macro quadrant, it will help guide you through this uncertain period:

Frame 1 – Q3 2023

It seems inflation is likely to continue its downward path. OPEC cut supply by 1mn barrels, and the oil price barely moved. This is yet another sign that the economic slowdown is underway (at least from the market’s perspective). Over the short/medium term, keep a close eye on CPI, ISM manufacturing/Services PMI, and labour statistics (non-farm payrolls, initial jobless claims, and unemployment). If the labour market continues to hold up and inflation continues to fall, this bear market rally could continue. Let’s not forget what happened after Bear Stearns collapsed in 2007:

S&P500 rally following Bear Stearns collapse

Look familiar?

S&P 500 Rally following SVB collapse

Because the bear market rally could continue does not mean you should participate. Cumulatively buying the top of each bear rally & selling at the bottom generated -86% PnL during the Dot-Com crash and -80% during the GFC of 2008. If you think this year’s rally has been bad, in the Dot-Com crash there were THREE bear market rallies above 30%!

Dot-Com bubble bear market rallies

Stay defensive and nimble. If you find an opportunity, take it, but be disciplined and cut your losses quickly if the position moves against you. Liquidity is likely to tighten again in the coming months, as quantitative tightening continues and the Treasury General Account (TGA) is rebuilt following the resolution of the debt ceiling debate. Liquidity drives markets, so this is a worry going into the second half of 2023.

Frame 2: Q4 2023

Assuming inflation does continue to fall, and the labour market remains resilient (over the next 1-3 months), Frame 2 is where it gets tricky. Inflation will be ~3-4% and the labour market may start to show some signs of weakness. At this point, two scenarios can occur and both are nasty. If the Fed pivots too early, inflation could rip higher again, leading to a loss of credibility for the central bank. This will lead to even more pain in the medium term, as the Fed will need to hike more aggressively than before. Therefore they would once again be kicking the proverbial can down the road. In this scenario, own precious metals and oil. I am sure tech will initially rally hard if there is a pivot, but this is unlikely to last. Bitcoin may also do well.

If Fed Chair Powell remains strong and refuses to cut rates even as cracks appear in the labour market and inflation is ~3%, then it will be time to buy bonds. ‘Don’t fight the Fed’ has always been the mantra, and this is true today more than ever. If the Fed hold interest rates at circa 5%, inflation is likely to be squashed as a recession becomes inevitable. Recessions have a 100% hit rate in killing inflation. However, do not be mistaken, the first-rate cut is not a signal to jump back into stocks again. Looking back at previous cycles, the worse of the bear market came just as rates were being cut, as this is when the economy finally falls apart. Keep a close eye on consumer-facing businesses (Mastercard, Visa etc) and analyst estimates for S&P 500 earnings. This will give you an idea of the estimates for the predicted depth of the downturn. Average recessions cause a 15% decline in earnings, so if that is not forecasted, there is money to be made. Remember, you cannot make money trading on consensus views (here’s a great interview by Howard Marks on the topic). In this scenario, bonds will perform very well, especially after the extent of the monetary tightening over the last year. This could also be a time for the brave to enter short positions.

Frame 3: Q4 2023 – Q2 2024

If the economy does fall into a recession, I have no doubt we will see rates at 0% and the money printer pumping once again. At this stage, you buy and pray. There will undoubtedly be volatility and huge fear in the market, but you must not hesitate. You can’t have the patience to wait and not have the stomach to execute when the time is right. The best market returns have come when ISM is negative but rising, and bond yields are down. You aren’t likely to pick the bottom, but as Warren Buffett says:

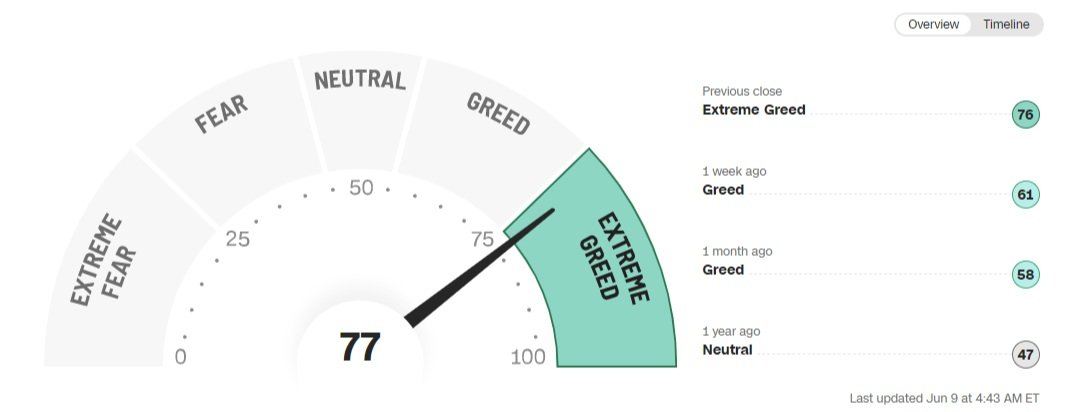

“Be fearful when others are greedy and be greedy when others are fearful.”

CNN Fear and Greed Index

As discussed here, I believe regardless of where markets end up, inflation will return. At the market bottom, I will load up on secular trends in the tech sector such as AI, DeFi, and renewables, but I believe investors should be more excited by Emerging Markets and commodities. Reshoring/Friend-shoring will benefit Latin American countries, which also will get a boost from the global energy transition too. I have discussed the investment opportunity with EMs in detail here.

Recent Actions

Higher and rising bond yields are killing the quality quadrant (see the macro quadrant above) and unprofitable/low-margin companies are continuing to fall. I will continue to focus on cheap assets and embrace international diversification. With this in mind, I am selling Suncor Energy and replacing it with the iShares MSCI Brazil ETF. Although the oil price didn’t budge after OPEC’s recent supply cuts, I am still attracted by the supply-demand dynamics of the traditional energy market, which I have written about many times in this newsletter. Brazil is a major exporter of Oil and other commodities, and its equity market is dirt cheap at 8x earnings. Brazil’s central bank is very orthodox and hiked its interest rate to 13.75% in order to tame inflation. It has worked and the current inflation rate is 4% (Brazil’s target is 3%, with a tolerance band of 1.5%). There are now calls for the central bank to cut rates, which would help boost the economy just at the time it's needed, with the recent slowdown in global growth. EMs are beginning to look more attractive as the US Dollar seems to have peaked, so I would like to add some more exposure following my purchase of Airtel Africa last week. The trend in Latin America is now to the upside. After ten years of underperformance versus the developed world, this could finally be the turning point for the region.

Action:

Selling Suncor Energy at a 42% (£128.25) profit

Adding 5% (24 shares) to iShares MSCI Brazil ETF (IBZL) at £20.64

Portfolio Return Year-to-date: -4.5% vs S&P500: 11.5%

Total Return since inception (20/09/2021): -1.7% vs S&P500: -3.1%

Let me know your thoughts by emailing me at thesparknewsletter@gmail.com

See you next time,

Peter

Disclaimer

This communication is for informational and educational purposes only and should not be taken nor used as investment advice, as a personal recommendation, or solicitation to buy or sell any financial instrument. This material has been prepared without considering any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or structured product are not, and should not be taken as, a reliable indicator of future performance. I assume no liability as to the accuracy or completeness of the content of this publication.